4 Basic – Business Strategies for Expansion

Navigating Business Development Strategies in 2024:

A Comprehensive Guide

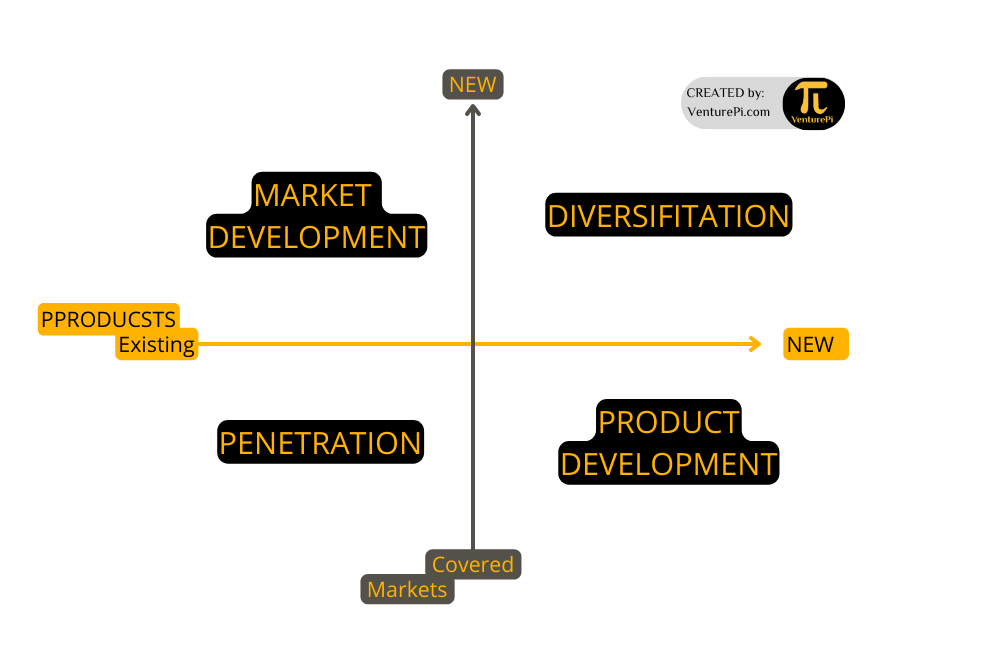

In the dynamic landscape of business, strategic development is key to staying ahead. As we reflect on the past year, it’s essential to analyze and refine our approaches for sustained growth. Let’s delve into four primary business development strategies that have shaped 2023:

Where to look for an opportunities for growth?

1. Diversification: Pioneering New Markets and Products

Embracing innovation, some businesses have boldly ventured into uncharted territory. Diversification involves the creation of new products coupled with the exploration of untapped markets. This strategy aims to spread risk and seize new opportunities.

2. Market Development: Expanding Horizons with Existing Products

For those who prefer expanding existing offerings, market development takes center stage. By approaching fresh markets with proven products, businesses can capitalize on their established strengths while reaching new audiences.

3. Product Development: Crafting Solutions for Familiar Markets

Innovation doesn’t always demand a change in scenery. Product development is about creating new solutions tailored to the needs of markets already in your portfolio. This strategy ensures relevance and competitiveness in your current sphere.

4. Penetration: Maximizing Impact in Familiar Markets

Sometimes, success lies in going deeper rather than broader. Penetration focuses on harnessing the full potential of existing products within markets that are already well-known. This approach demands a keen understanding of customer needs and strategic marketing.

Navigating the Future: Your Business, Your Strategy

As we navigate the intricate web of business development, it’s crucial to align strategies with organizational goals and market dynamics. Whether you’ve embraced diversification, market development, product development, or penetration, the key lies in adaptability and continuous evaluation.

Share your insights and experiences!

How has your chosen strategy shaped your business in 2023? What lessons have you learned, and what adaptations are in store for the future?

Conclusion: Shaping Tomorrow, Today

Business development is an ever-evolving journey, and the strategies we choose shape our trajectory. As we move forward, let’s leverage the lessons of the past to craft a resilient and forward-looking approach for sustained success in the dynamic markets of 2023.

*Stay tuned for more insights on business strategies, innovation, and industry trends!* #BusinessDevelopment #Strategy2023 #Innovation #MarketInsights